Dear Valued Members,

Along with the Global Convention 2019 in Taiwan, there are some global regulation adjustments as follows:

[Business Account Management Fee]

From September 2019 (from October commission payment onwards)

Along with the increase in the number of members, a considerable amount of money is needed for system maintenance and security measures, etc. Therefore, an equivalent worth of 500 PV will be deducted from the bonus at the time of commission transfer as a Business Account Management Fee.

※ For the countries which have been charging Transfer Fee so far, it will be changed into this Business Account Management Fee instead.

※ Transfer is made when monthly bonus reaches 3,000 PV equivalent or more. Business Account Management Fee will not be charged when commission is less than 3,000 PV equivalent. This fee is charged only in the month when the total amount reaches 3,000 PV equivalent or more and the bonus transfer is made.

※ For countries applying weekly payment and spot payment, 500PV equivalent will be deducted from the monthly commission transfer on the 25th. No fee deduction is made at the time of weekly payment and spot payment.

※ In countries applying weekly payment and spot payment, in addition to the equivalent of 500 PV, a bonus payment service fee equivalent to 100 PV is charged each time of weekly payment or spot payment.

[Global Calculation Fee]

From September 2019 (from October commission payment onwards)

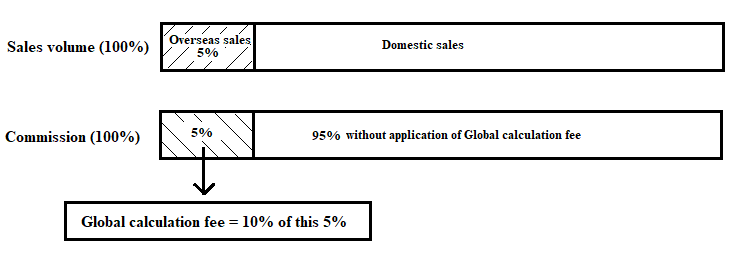

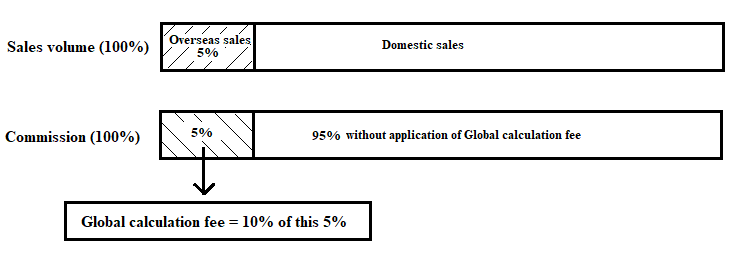

Since revenues made outside of members’ registered countries must be transferred back, a Global Calculation Fee will be applied and calculated for each member based on the percentage of overseas sales figure in one’s own binary organization. The Global Calculation Fee is equal to 10% of such percentage over total commission of the member.

For a certain member, the calculation will be as follows:

Consider the percentage of overseas sales figure in one’s own binary organization as A%

=> Global Calculation Fee = 10% × [A% × (total commission)]

For example:

In the organization of member X in October 2019, total sales volume is 1,000,000 PV.

Overseas sales of his organization is 50,000 PV, which accounts for 5% of his organization’s total sales volume.

His October commission is 200,000 PV.

=> Global calculation fee = 10% × [5% × 200,000PV] = 1,000 PV

※ If there is a fraction, it will be rounded off.

※ NFR is considered as one registered country.

[Regarding the purchase of bonus-eligible products outside the registered country]

From October 1, 2019

So far, when members purchase bonus-eligible products in countries other than their registered country, there exists a problem of fund transfer, which results from the difference between product purchase country and bonus payment country. Therefore, from October 1st, 2019, product purchase should be made only in your own registered country.

[Administrative handling fee in case of country change]

From October 1, 2019

For conducting a country change, 3,000PV equivalent will be charged uniformly as an Administrative handling fee.

In addition, within 6 months after a country change, members cannot have their country changed again unless they have rational reason like moving to a new residence address, etc.

[Membership transfer fee]

From October 1, 2019

For conducting a membership transfer to spouse, 3,000PV equivalent will be charged uniformly as a handling fee.

For conducting a membership transfer in case of a member’s death, 3,000PV equivalent will be charged uniformly as a handling fee.